Federal Bank’s Strong Performance in Q3

Impressive Profit Growth

Federal Bank, based in Mumbai, has reported a remarkable 23% increase in consolidated net profit, reaching Rs 1,035.42 crore for the December quarter of 2023-24. This surge in profit can be attributed to a significant reduction in provisions and a substantial rise in non-interest income. On a standalone basis, the bank achieved its highest-ever net profit in a quarter, soaring by 25% to Rs 1,007 crore.

Key Financial Highlights

The core net interest income (NII) witnessed a growth of 8.53%, amounting to Rs 2,123 crore, while the other income surged by an impressive 61% to Rs 863 crore. Despite a narrowing of the net interest margin (NIM) to 3.19% from 3.55% in the previous year, the bank’s asset growth of 18% provided significant support.

Strategic Focus and Challenges

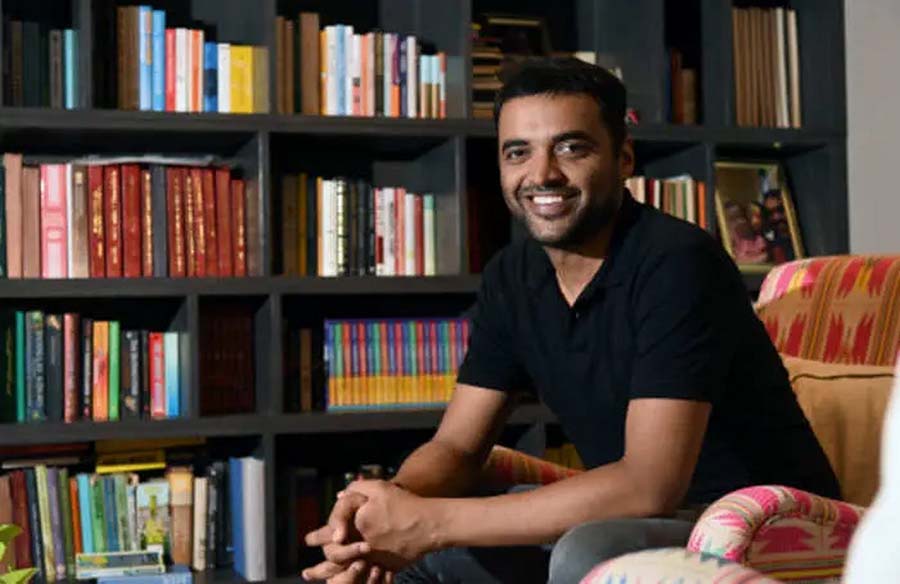

CEO and Managing Director, Shyam Srinivasan, highlighted the bank’s emphasis on overall income growth from both interest and non-interest income streams. However, challenges persist, particularly in expanding NIMs amidst a demanding external environment with higher funding costs.

Future Plans and Leadership Succession

Federal Bank is committed to expanding its branch network, with plans to open 100 new branches in 2024. Additionally, the board has initiated the process of selecting a successor for Srinivasan, who will step down after 15 years of service in September. The bank aims to maintain its asset quality targets and improve its capital adequacy ratio further.

Asset Quality and Provisions

Despite a slight increase in overall slippages, the bank remains within its target for FY24. Gross non-performing assets (NPA) ratio improved to 2.29% from the previous year’s 2.43%, while overall provisions decreased significantly, contributing to bottom-line growth.

Conclusion

Federal Bank’s robust performance in Q3 reflects its resilience and strategic focus amidst evolving market dynamics. With prudent financial management and a forward-looking approach, the bank is poised to navigate challenges effectively while driving sustainable growth.