The Fed’s Conundrum: Striking a Balance in Monetary Policy

As economic indicators fluctuate and market expectations evolve, the Federal Reserve faces a challenging dilemma regarding the trajectory of interest rates. Despite earlier speculations of impending rate cuts, recent economic data has tempered optimism and raised questions about the necessity of such actions.

Mixed Signals from the Economy

Recent economic data paints a mixed picture of the US economy. While January’s inflation exceeded expectations, with the Consumer Price Index (CPI) rising to 3.1% year-over-year, other indicators, such as nonfarm payrolls and GDP growth, remain robust. Additionally, the housing market continues to thrive, with home prices soaring to new heights. However, concerns linger regarding the resilience of consumer spending, as evidenced by softer-than-expected retail sales data released in January.

The Case for Patience

San Francisco Fed President Mary Daly emphasized the need for patience and vigilance in monetary policy decisions. Despite market expectations of rate cuts, Daly urged against premature actions, highlighting the importance of closely monitoring economic developments and resisting the temptation to act hastily. This sentiment is echoed by economists like Joe Seydl, who believe that the economy is poised for continued growth, making rate cuts unnecessary at this juncture.

Balancing Act

While some argue for maintaining higher interest rates to prevent distortions in investment activity, others caution against the risks of tightening monetary policy too aggressively. Jimmy Chang, the chief investment officer for Rockefeller Global Family Office, contends that cutting rates prematurely could reignite inflationary pressures, undermining the Fed’s credibility. Similarly, concerns persist regarding the cumulative impact of previous rate hikes on various sectors of the economy, suggesting that the full effects of tighter monetary policy may not have been realized yet.

Reading the Tea Leaves

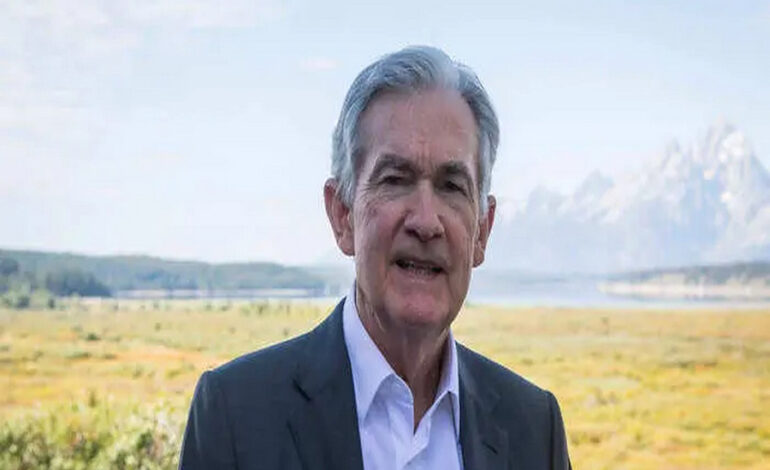

Market sentiment remains divided, with projections for rate cuts fluctuating in response to economic data releases. While the Fed’s own dot plot projections suggest potential rate cuts in 2024, the timing and extent of such actions remain uncertain. Powell’s transparent communication regarding the central bank’s outlook has contributed to market stability, despite fluctuations in economic indicators. However, the Fed’s next move will depend on a careful assessment of evolving economic conditions and inflationary pressures.

Looking Ahead

As the Fed navigates the complexities of monetary policy, economists and market participants alike await further clarity on the central bank’s stance. While the case for keeping rates unchanged has gained traction in recent weeks, the possibility of rate cuts in the future cannot be ruled out entirely. Ultimately, the Fed’s decisions will be guided by its dual mandate of promoting maximum employment and maintaining price stability, with a keen eye on mitigating risks to the overall economy.

In conclusion, the Fed faces a challenging task of balancing competing priorities and responding to evolving economic dynamics. With uncertainties lingering and economic indicators sending mixed signals, policymakers must tread carefully to avoid unintended consequences. By adopting a data-driven approach and maintaining open communication with markets, the Fed aims to navigate the intricacies of monetary policy while supporting sustainable economic growth.